Commonwealth Bank

Interest Rates:

Starting around 4.5%

Loan Amounts:

$10,000 to $5 Million

Repayment:

Early repayment without penalties

Loan Types:

Secured & Unsecured, Industry-specific

Get Clara McKinley's expert advice on Australian business loans delivered right to your inbox.

Posted on: 2025-10-16

By: Clara McKinley

When evaluating business loan providers, understanding the differences can empower you to make informed decisions that align with your growth goals. As you navigate the offerings of Commonwealth Bank and Westpac, consider how these insights could impact your financial journey.

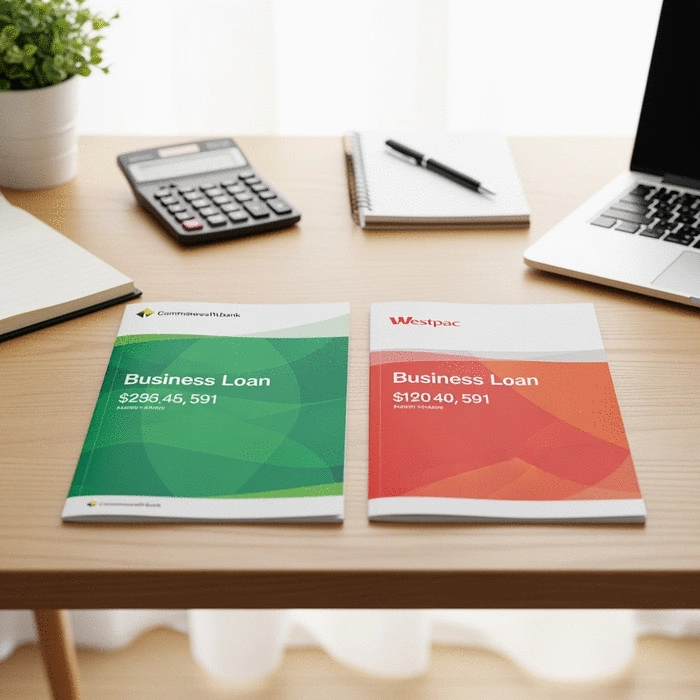

A side-by-side comparison of key offerings from two prominent Australian banks to help you make an informed decision.

Interest Rates:

Starting around 4.5%

Loan Amounts:

$10,000 to $5 Million

Repayment:

Early repayment without penalties

Loan Types:

Secured & Unsecured, Industry-specific

Interest Rates:

Starting around 5.0%

Loan Amounts:

$5,000 to $1 Million

Repayment:

Flexible schedules, customized to cash flow

Loan Types:

Secured & Unsecured, Industry-specific

When it comes to securing funding, understanding your options is vital. Choosing the right business loan provider can greatly impact your financial journey. By comparing business loan providers, you can make informed decisions that align with your goals. This process helps ensure that you select a banking partner who not only meets your financial needs but also supports your business vision as you grow. The Australian Parliament House provides further insights into the role of major banks in the Australian economy.

As a small business owner myself, I understand the importance of evaluating loan options. It's not just about the money; it's about finding a partner that aligns with your business values and long-term objectives. In this article, we will take a closer look at the offerings from Commonwealth Bank and Westpac, two prominent players in the Australian banking landscape.

Evaluating different loan options is essential for any business owner. By comparing lenders, you can identify which one offers the best terms, interest rates, and additional services tailored to your industry. Understanding the differences can save you time, money, and headaches down the line.

Taking the time to analyze these factors can empower you to make better financial decisions and foster a successful partnership with your lender.

When it comes to business loans, interest rates and associated fees are critical components of the overall cost of borrowing. Both Commonwealth Bank and Westpac provide a range of options, but how do they compare? Understanding their interest rates can help you decide which option is more financially viable for you. The Council of Financial Regulators offers a review into small and medium-sized banks, which often compete with larger institutions on interest rates.

Each bank has its unique fee structure as well, which can significantly affect your total repayment amount. It's crucial to analyze these factors before making your choice.

Loan terms can vary widely between lenders and types of loans. Both Commonwealth Bank and Westpac offer secured and unsecured loan options, each catering to different business circumstances. Secured loans usually require collateral, while unsecured loans do not, making them accessible to startups or businesses without significant assets.

Understanding which type of loan fits your business model will help you align your financing strategy with your growth plans.

Repayment terms are another crucial aspect to consider. Both Commonwealth Bank and Westpac offer different levels of repayment flexibility that can suit various business cash flow situations. You want a loan that not only meets your current needs but also provides options for the future.

Choosing a lender with favorable repayment terms can significantly affect your financial health, helping you maintain your business’s cash flow.

Each bank offers specialized financing options aimed at different industries. Understanding these offerings can help you find the perfect fit for your business needs.

Identifying the right loan tailored to your specific industry can provide you with an edge in securing the financing you need.

Understanding the typical loan amounts offered by Commonwealth Bank and Westpac is essential for aligning your financing strategy with your business goals. Each bank has its limits, which can cater to various business sizes and needs.

Assessing the loan amounts available can help you determine which bank fits your financial aspirations best and sets you up for success. Further details on credit reporting and its impact on loan access are available from the Treasury's review of Australia's credit reporting framework.

Here's a brief recap of the key points discussed so far:

As we wrap up our comparison between Commonwealth Bank and Westpac, it’s important to reflect on what we've learned. Both banks offer unique strengths and weaknesses, catering to different business needs and preferences. Choosing the right bank isn’t just about the interest rates; it also involves understanding their overall offerings, support services, and how they align with your business goals.

To help clarify the decision-making process, here’s a recap of the main points:

Understanding these aspects can greatly aid in selecting a banking partner that aligns with your business aspirations. Remember, it’s essential to weigh the pros and cons based on your specific requirements and financial situation.

Now that you have a better grasp of what both banks offer, it’s time to make an informed decision! I recommend using online comparison tools or calculators to assess your specific needs and preferences. These tools can help you visualize loan options and evaluate costs effectively.

Here’s how you can get started:

These steps can simplify the daunting process of loan selection and empower you to make decisions that support your business’s growth.

Once you've narrowed down your bank choice, the next step is applying for a loan. Here’s a straightforward guide to help you navigate through the application process:

Understanding these steps will not only streamline your application but also help set realistic expectations regarding approval timelines.

Ready to take the plunge? It’s time to start your loan application process with the bank that fits your needs best! For your convenience, I’ve compiled some resources below:

If you have questions or need further assistance, feel free to reach out! Remember, securing the right funding is a crucial step towards achieving your business goals, and I’m here to help you on your journey.

Here is a quick recap of the important points discussed in the article:

Did you know that nearly 80% of small business owners rely on reviews when selecting a lender? Under

Did you know that nearly 80% of small business owners rely on reviews when selecting a lender? Under

In the world of finance, a timely decision can be the difference between success and stagnation. Hav

In the world of finance, a timely decision can be the difference between success and stagnation. Hav

Unlocking your financial potential can be transformative. With the right strategies, managing debt b

Unlocking your financial potential can be transformative. With the right strategies, managing debt b